Immediate response is critical

Banks need to quickly adjust to the new market conditions. Understanding of the gravity of the new situation and its impact to the bank portfolio is a critical first step in taking the right decisions to safely overcome the crisis. The stress testing tailored to specific segments of the portfolio will help you to understand the possible portfolio behavior in specific market conditions.

Remote project delivery

COVID 19 spreading around the globe limits the possibility of on-site project delivery. We believe that a remote project with an experienced partner such as Adastra with a structured approach to portfolio stress testing is the best way to go.

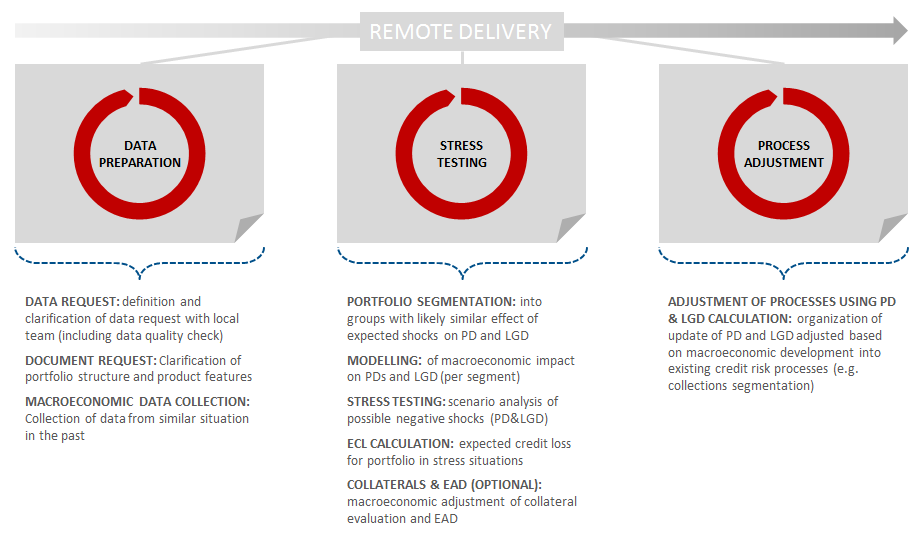

Project scope

We will help you to execute end to end stress testing remotely with our battle tested stress testing framework. As a result we will simulate portfolio behavior in stress situations and its impact on expected credit loss. Also we will help you to incorporate adjusted PD and LGD based on expected macroeconomic developments into collections segmentation and other risk processes.

During the project we will:

- help you to gather needed data & perform data quality checks,

- segment your portfolio into groups with likely similar effect of expected shocks on PD and LGD,

- model macroeconomic impact on PDs and LGD in every portfolio segment,

- perform scenario analysis of possible negative shocks and calculate adjusted PD & LGD,

- calculate expected credit loss for current and future portfolio in stress situations,

- incorporate adjusted PD and LGD based on macroeconomic development into collections segmentation and other risk processes.

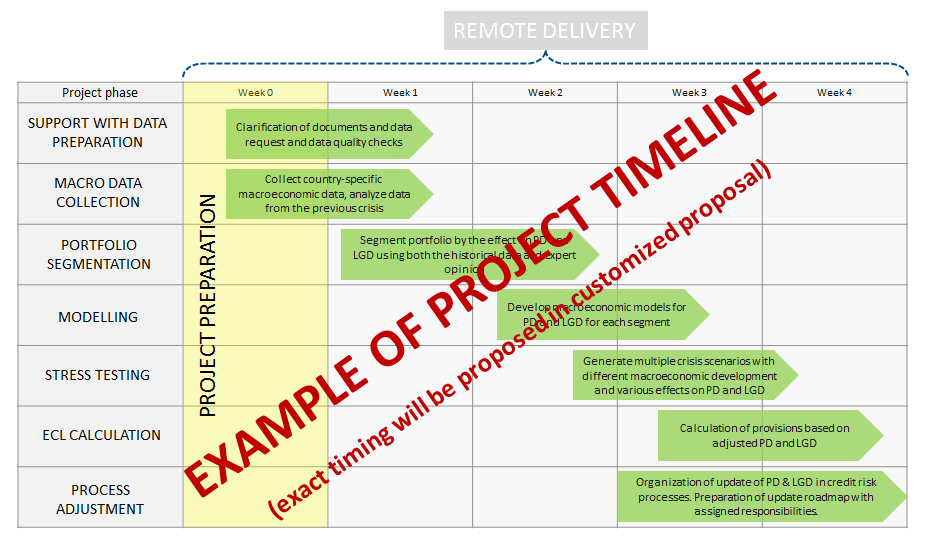

Timing:

4-6 weeks according to the number of products

If you are interested, contact us.